Spending in leisure, amusement and theme parks in the Middle East and Africa was expected to reach US$609 million (Dh2.23 billion) in 2023;

Customer attendance is projected to increase at a 12.2 percent compound annual rate to 13.0 million in 2023 from 7.3 million in 2018;

UAE Government has announced that it plans to attract 40 million tourists to the country every year by 2040 with investment to the tune of Dh100 billion that will further diversify the country’s economy and reduce its dependence on oil;

Along with direct and indirect contribution, the Middle East’s Travel and Tourism industry generates US$237 billion (Dh870 billion) worth of economic activity, according to the World Travel and Tourism Council (WTTC);

The global amusement parks market grew from $42.68 billion in 2021 to $69.27 billion in 2022 at a compound annual growth rate (CAGR) of 62.3 percent;

The worldwide amusement parks market is expected to grow to $140.5 billion in 2026 at a CAGR of 19.3 percent.

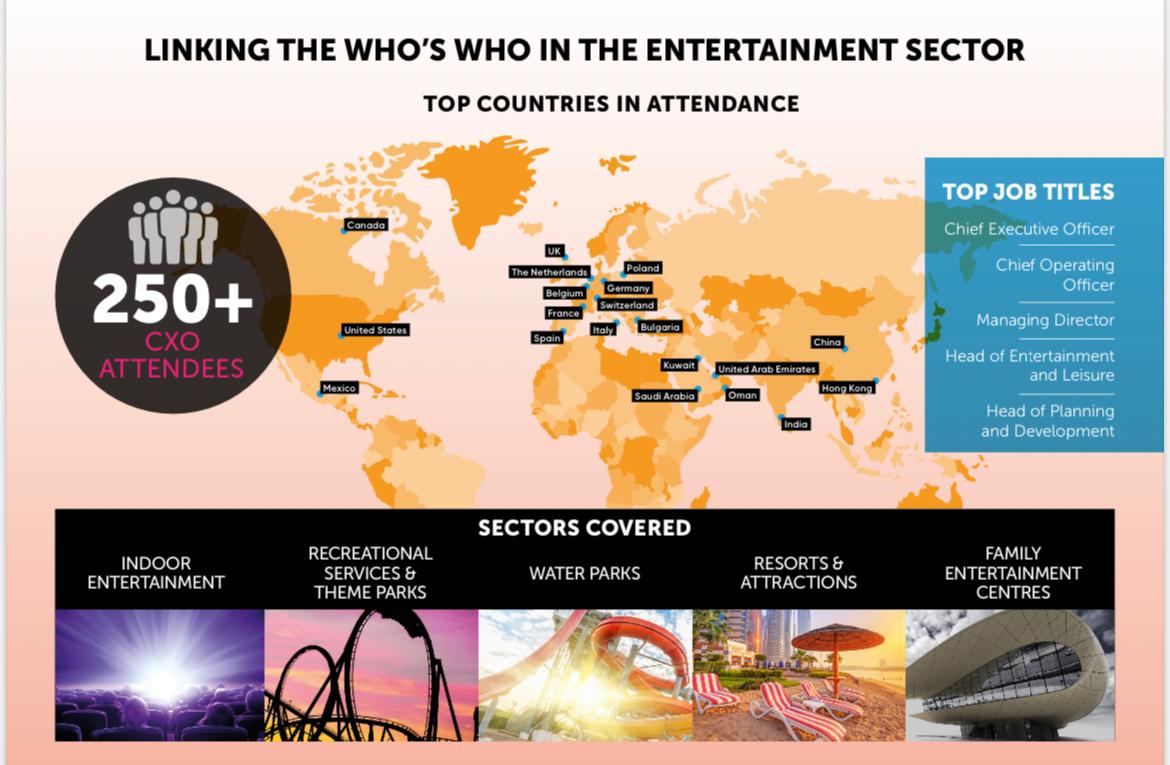

Spending in leisure, amusement and theme parks in the Middle East and Africa was expected to reach US$609 million (Dh2.23 billion) in 2023, according to a report issued by International Association of Amusement Parks and Attractions (IAAPA), the global industry association, as more than 250 industry experts, CEOs, COOs, MDs Head of the Leisure and Entertainment department from 75 participating companies from Theme parks, Water parks, Resorts, Family Entertainment Centres plan to attend he first Saudi Theme Parks & Entertainment Confex, scheduled to take place at the Raddison Blu, Riyadh on March 06, 2023.

The day-long convention takes place at a time when the leisure industry has started to grow at an exponential rate following the COVID-19 pandemic and boosted by the Expo 2020 and FIFA World Cup Football in Qatar that kicks off in a few days’ time.

The event announcement comes just a few days after Abu Dhabi’s Miral Asset Management had launched a new group identity to streamline the delivery of Dh13 billion (US$3.5 billion) worth of leisure and cultural projects across the emirate.

“Trade, tourism and retail are key economic growth drivers that will push the economies of the GCC countries in the years to come. These sectors are playing a pivotal role in diversifying the economy of the Gulf countries and will play even greater role in the economy,” Nizam Deen, Founder and Chief Executive Officer of CS Events – organiser of the UAE Corporate Tax Forum, says.

“Recently the UAE Government has announced that it plans to attract 40 million tourists to the country every year by 2040 with investment to the tune of Dh100 billion that will further diversify the country’s economy and reduce its dependence on oil. Therefore, the countries in the GCC region will now sharpen their focus in developing leisure tourism facilities to attract more visitors.

“The event will highlight the upcoming leisure projects that will help the industry grow further. The first Saudi Theme Parks & Entertainment Confex will bring the industry stakeholders closer to each other and they would then benefit immensely from the deliberations and the huge opportunities coming their way.”

Along with direct and indirect contribution, the Middle East’s Travel and Tourism industry generates US$237 billion (Dh870 billion) worth of economic activity, according to the World Travel and Tourism Council (WTTC). In the Middle East, Travel and Tourism represents 8.7 percent of the region’s Gross Domestic Product (GDP) and supports 5.4 million jobs. In North Africa, Travel and Tourism represents 11.2 percent of the region’s GDP, and supports 5.6 million or 10.4 percent of all jobs, WTTC research shows.

The report projects attendance to increase at a 12.2 percent compound annual rate to 13.0 million in 2023 from 7.3 million in 2018. It expects overall theme and amusement park spending to grow at an 18.1 percent compound annual rate to $605 million in 2023 from $263 million in 2018.

This conference will create massive business opportunities that are going to keep suppliers and manufacturers busy and help boost the leisure entertainment and attractions industry.

Organised by CS Events Management, the Saudi Theme Parks & Entertainment Confex 2023, will bring together decision makers from Tourism Authorities, Entertainment Sector, Family Entertainment Centres, Resorts & Attractions, F & B, Developers etc. to discuss and evaluate the latest of Saudi Arabia’s development in “Theme parks, Entertainment and Leisure” market, while showcasing cutting edge technology and solutions to real buyer.

The global amusement parks market grew from $42.68 billion in 2021 to $69.27 billion in 2022 at a compound annual growth rate (CAGR) of 62.3 percent, according to research reports. The amusement parks market is expected to grow to $140.5 billion in 2026 at a CAGR of 19.3 percent.

The entertainment industry of Saudi Arabia is growing massively. Saudi Arabia has been putting its best effort to build a unique and world-class entertainment hub that includes innovative rides, cultural or historical attraction, and mega sporting events.

It will also have accommodation facilities and merchandise in amusement parks that are gaining popularity among visitors of all age groups. Its entertainment sector offers an enormous opportunity for companies operating in this space.

According to Renub Research, the Saudi Arabia Entertainment & Amusement market will reach US$1.17 billion by the end of the year 2030.

Industry experts will address the key issues, challenges and trends in the industry through presentations and panel discussions on this forum. Speakers from 20 countries, including countries from North America, Europe, Asia and Middle East will discuss challenges and opportunities and vendors and solution providers will get a chance to showcase the latest innovations in front of hundreds of industry leaders.

The Leisure and Attractions Industry is a great contributor to the tourism sector and our regional economies, industry experts said at the conference.

The Saudi government has played a central role in supporting the growth of the entertainment sector by implementing the General Authority for Entertainment (GAE) established under the umbrella of the Public Investment Fund (PIF).

Saudi Arabia is creating a host of attractions and giga-projects as part of Vision 2030, including the first water park in Saudi Arabia at Qiddiya. The company has awarded a contract worth 2.8 billion Saudi riyals ($750 million) for the construction of the kingdom’s first and the region’s largest water theme park.

Qiddiya, which is being built in the outskirts of the Riyadh, is one of several mega-projects being developed in the kingdom as part of Saudi Arabia’s Vision 2030 programme, the overarching blueprint to overhaul the kingdom’s economy and reduce its dependence on hydrocarbon revenue.

Saudi Arabia’s Al Hokair Group has partnered with Hasbro to launch a unique family entertainment centre (FEC) concept called Playocity across the kingdom. Additional developments include the kingdom’s $500 billion city of the future Neom and the Red Sea Project.

Saudi Arabia’s Public Investment Fund (PIF) has issued a request for proposals (RFP) from global oil and gas contractors for a $5bn ‘oil rig theme park’ called The Rig. The Rig will be an offshore ‘extreme park’ in the Persian Gulf. Covering an area of more than 150,000 square metres, the attraction will be situated on repurposed oil platforms.

The region’s theme parks are currently getting busier with a growing number of visitors and investing heavily in technology to create fully immersive and connected guest experiences they cannot get anywhere else.

Experts will discuss on the digitalization of Theme Parks as well. The various experience upgrades that the industry in the Middle East are investing in include the deployment in digital ticketing, cloud-base solutions, digital payment, augmented and virtual reality, experiential attractions etc.

The Saudi Theme Parks & Entertainment Confex conference will highlight the massive business opportunities in the the Middle East, especially Saudi Arabia, where government and the private sector investors are injecting billions of dollars to build new theme parks, amusement parks, large cinema complexes, shopping malls with family entertainment centres – that will help the suppliers and manufacturers of leisure products to expand their businesses.

Table 1: UAE Tourism

| Value | Factors |

| Dh180.4 bn | Total tourism revenue in the UAE in 2019 |

| Dh30 billion | Hotel revenues in the UAE in 2019 |

| Dh143.1 billion | Total tourism expenditure in the UAE in 2019 |

| 11.6% | Contribution to the UAE GDP in 2019 |

| 180,000 | No. of hotel rooms in the UAE in 2020 |

| 1,089 | No. of hotels in the UAE in 2020 |

Table 2: Biggest Mega Projects – with Leisure Components – in the Middle East

Biggest megaprojects in the Middle East |

||||||

| No | Project | Project owner | Country | Status | Value (US$ bn) | End |

| 1 | Neom | Public Investment Fund | KSA | Study | 500 | 2030 |

| 3 | Dubailand | Dubai Holding | UAE | Execution | 146.85 | 2030 |

| 3 | King Abdullah Economic City | Emaar, The Economic City | KSA | Execution | 93 | 2034 |

| 4 | Lusail development | Lusail Real Estate Development Company | Qatar | Execution | 45 | 2022 |

| 5 | Al-Reem Island | Bunya Enterprises | UAE | Execution | 37 | 2023 |

| 6 | Yas Island | Aldar Properties | UAE | Execution | 37 | 2030 |

| 7 | Dubai Waterfront | Nakheel | UAE | Execution | 35 | 2030 |

| 8 | Business Bay | Dubai Properties | UAE | Execution | 30 | 2030 |

| 9 | Jeddah Economic City | Jeddah Economic City | KSA | Execution | 30 | 2031 |

| 10 | Saadiyat Island | Tourism Development & Investment Company | UAE | Execution | 27 | 2030 |

| 11 | Palm Jumeirah | Nakheel | UAE | Execution | 21 | 2030 |

| 12 | Downtown Dubai | Emaar Properties | UAE | Execution | 20 | 2030 |

| 13 | Heart of Jeddah Development | Jeddah Development & Urban Regeneration Co. | KSA | PQ | 20 | 2034 |

| 14 | Al-Raha Beach | Aldar Properties | UAE | Execution | 15 | 2020 |

| 15 | The World | Nakheel | UAE | Execution | 14.05 | 2030 |

| 16 | Al-Khiran City | Public Authority for Housing Welfare | Kuwait | Study | 14 | 2035 |

| 17 | Arabian Bays (Jadaf) | Dubai Holding | UAE | Execution | 13.5 | 2030 |

| 18 | Deira Islands | Nakheel | UAE | Execution | 12.5 | 2035 |

| 19 | Dubai Marina | Emaar Properties | UAE | Execution | 12.3 | 2025 |

| 20 | Marsa Zayed | Al-Maabar | Jordan | Execution | 10 | 2021 |

| 21 | Barwa Al-Khor Development | Barwa Real Estate Company | Qatar | Execution | 10 | 2025 |

| 22 | Roua Al-Madinah | Public Investment Fund | KSA | Study | 10 | 2027 |

| 23 | Roua Al-Haram | Public Investment Fund | KSA | Study | 10 | 2029 |

| Source: MEED Projects | ||||||

Table 3: New Theme Park Ride Projects in the GCC

| Project | Type | Park | Country | Year |

| Bombay Express | Roller coaster | Bollywood Parks | UAE | 2022 |

| Falcon’s Flight | Roller coaster | Six Flags Qiddiya | KSA | 2023 |

| SHarry Potter Land | Themed area | Warner Bros. Abu Dhabi | UAE | Unknown |

| Mission Ferrari | Roller coaster | Ferrari World | UAE | 2022 |

| NEOM | Destination | NEOM | KSA | 2022 |

| Red Sea Project | Destination | Red Sea Project | KSA | 2022 |

| SeaWorld Abu Dhabi | Amusement Park | SeaWorld Abu Dhabi | UAE | 2023 |

| Six Flags Qiddiya | Amusement Park | Six Flags Qiddiya | KSA | 2023 |

| Storm | Roller coaster | Dubai Hills Mall | UAE | 2022 |