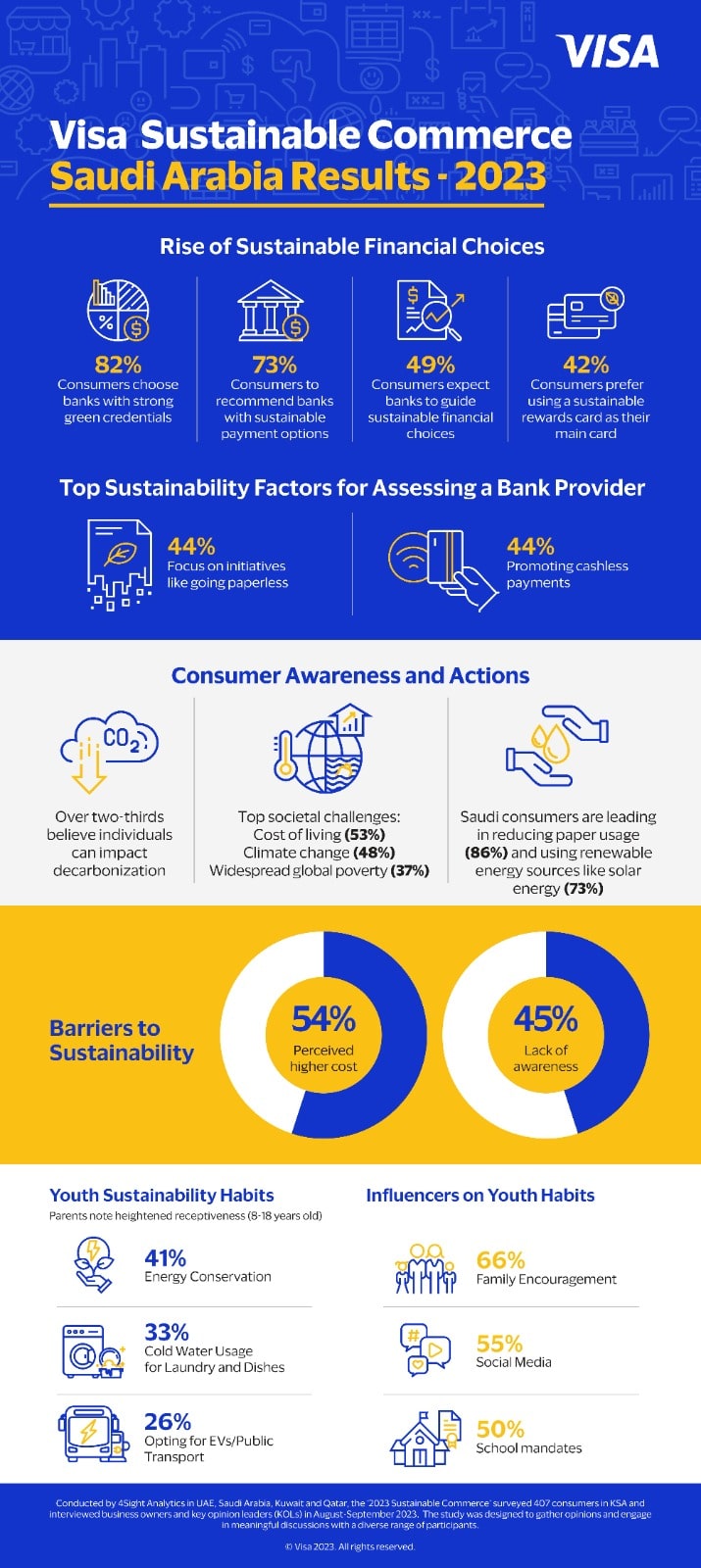

• Study released during COP28 reveals forty-nine percent (49%) of surveyed consumers in Saudi Arabia anticipate their banks to guide them in making sustainable choices for their finances.

• Fifty-four percent (54%) of consumers believe higher cost of sustainable products is top barrier to purchase, followed by lack of awareness (45%).

• Interviews with SMBs and experts reveal desire to adopt sustainable practices but often hindered by lack of technical know-how.

Riyadh, Kingdom of Saudi Arabia-: Visa, a world leader in digital payments, released the Saudi Arabia results of their ‘2023 Sustainable Commerce’ study today during the United Nations Climate Change Conference (COP28). The study scrutinizes consumer and business behaviors, and the readiness of infrastructure to support sustainable commerce. The survey reinforces the urgency for all industry stakeholders to take decisive collective action to promote sustainability through responsible innovation for the benefit of consumers, businesses and the economy.

Key Findings for Saudi Arabia:

– Consumers are aware and doing something about sustainability:

o Over two-thirds of Saudi consumers believe that decarbonization is not limited to corporate entities, and individuals can make a difference. More importantly, in Saudi Arabia, survey respondents view the rising cost of living as a leading societal challenge (53%), followed by climate change/global warming (48%), and widespread global poverty (37%).

o In terms of environmental practices, Saudi consumers are leading in reducing paper usage (86%), surpassing the GCC average of 84%, as well as using renewable energy sources like solar energy (73%). From an ethical sourcing perspective, Saudi Arabia is leading by promoting urban agriculture like rooftop farming (76%) across the GCC. Additionally, 67% of Saudi consumers pay premium for brands or products that are sustainably produced. Saudi Arabia shows robust awareness and support for NGOs promoting sustainability (54%), exceeding the GCC average of 53%, and excels in repurposing by supporting borrowing or reusing products at 68%, compared to the GCC average of 64%.

– Future bank customers: making sustainable choices

o 73% of individuals have expressed their willingness to endorse banks that provide sustainable payment options. Additionally, 82% of consumers reported selecting a bank with strong green credentials. Moreover, nearly half of the surveyed consumers (49%) anticipate their banks to guide them in navigating sustainable financial choices.

o Interestingly, 45% of consumers also would like their banks to be open about their environmental impact and keep them informed.

– Sustainability among the next generation:

o In Saudi Arabia, parents of young consumers (8-18 years old) noted their children demonstrate a heightened receptiveness to sustainable practices and a greater environmental consciousness. Their adopted habits include switching off electrical appliances not in use (41%), washing dishes or laundry with cold water (33%), choosing to use electric vehicles or public transport or carpool to reduce emissions (26%), opting to buy from brands that have sustainable products (29%), and get involved in activities to create awareness about preserving the environment (37%).

o The primary influencers driving sustainability habits among the youth include family members encouraging sustainable behaviors (66%), social media (55%) and school mandates (50%).

– Sustainable benefit becomes a feature attraction: the key to becoming a primary card

o Rewards for sustainable behaviors are a significant attraction, with 42% of consumers willing to make such a card their primary one.

o Sustainability evaluations of bank providers are still mainly focused on known initiatives like reducing paper and byproduct usage.

o Factors considered while evaluating a bank provider on sustainability include simplified net banking for easy and sustainable transactions (48%), going paperless (44%) and promoting cashless payments (44%).

– Barriers to sustainability

o A significant barrier for the majority of Saudi consumers (54%) lies in the perceived higher cost of sustainable products, closely followed by a lack of awareness (45%) regarding sustainability.

o As societal consciousness regarding social and environmental issues expands, the study indicates a rising preference among consumers for businesses that actively demonstrate sustainable practices.

Businesses and Sustainability

Qualitative interviews revealed that MSMEs and KOLs have a fair understanding of sustainability but lack a holistic and contextual comprehension of the concept. This gap is influenced by several barriers, including cost implications for both businesses and consumers, fear and resistance to change, pressures from competition and profitability, and resource constraints. However, there are also enablers that can foster sustainability. These encompass regulatory policies and frameworks that create the right ecosystem, sustainable financing that provides a ‘push’ effect, and the necessity for collaboration among stakeholders to drive sustainability. Visionaries, typically medium-sized businesses, grapple with significant pressure from global partners to adopt sustainability standards. However, they are often hindered by a lack of technical knowledge.

Ali Bailoun, Visa’s Regional General Manager for KSA, Bahrain and Oman, said: “Visa is stepping up to help our partners guide their consumers towards more eco-friendly decisions. With over 49% of consumers in Saudi Arabia seeking such guidance from their banks, Visa is offering insights into the environmental impact of their purchases. With billions of cards and millions of merchant partners worldwide, Visa is uniquely positioned to foster environmentally responsible consumption patterns, promote sustainable transport, and empower individuals, communities, and countries in their transition to a net-zero economy.”

Visa is committed to facilitating sustainable commerce and contributing to the transition to a net-zero economy. Visa leverages digital payments to promote environmentally responsible consumption, sustainable transport, and Electric Vehicle adoption, while also reducing its own environmental footprint with a goal of net-zero emissions by 2040. In GCC, Visa recently launched the Eco Benefits Bundle, a groundbreaking climate banking platform in collaboration with ecolytiq and Mashreq in the UAE, and with QIB in Qatar. This innovative solution integrates eco-friendly features into card payments, enabling users to track their environmental impact and contribute to carbon offset initiatives.

Conducted by 4Sight Analytics in Saudi Arabia, UAE, Kuwait and Qatar, the ‘2023 Sustainable Commerce’ surveyed 407 consumers in Saudi Arabia and interviewed business owners and key opinion leaders (KOLs) in August-September 2023. The study was designed to gather opinions and engage in meaningful discussions with a diverse range of participants.